Does Tennessee Have Real Estate Taxes . The median annual property tax paid by homeowners in tennessee is $1,317, about half the. tennessee, like most states, has a property tax. The tax is based on the value of the property. Even if the property was. real estate taxes vary by municipality across tennessee, with an average tax rate of 0.67 percent of a home’s assessed value in 2021,. Understanding how these taxes are calculated, what factors. if you're wondering about property taxes in tennessee, you're not alone. The county levies and collects this tax on real estate. County assessors of property appraise real estate for assessment. the department of revenue does not collect property tax. tennessee has some of the lowest property taxes in the u.s. if you own property as an individual or a business, you are required to pay tennessee property tax. the median property tax in tennessee is $933.00 per year for a home worth the median value of $137,300.00.

from dxohuhtke.blob.core.windows.net

The tax is based on the value of the property. The median annual property tax paid by homeowners in tennessee is $1,317, about half the. County assessors of property appraise real estate for assessment. tennessee, like most states, has a property tax. Understanding how these taxes are calculated, what factors. real estate taxes vary by municipality across tennessee, with an average tax rate of 0.67 percent of a home’s assessed value in 2021,. Even if the property was. the median property tax in tennessee is $933.00 per year for a home worth the median value of $137,300.00. if you're wondering about property taxes in tennessee, you're not alone. if you own property as an individual or a business, you are required to pay tennessee property tax.

Rutherford Tn Property Tax at Peter Morris blog

Does Tennessee Have Real Estate Taxes tennessee, like most states, has a property tax. Even if the property was. the median property tax in tennessee is $933.00 per year for a home worth the median value of $137,300.00. if you own property as an individual or a business, you are required to pay tennessee property tax. The tax is based on the value of the property. tennessee has some of the lowest property taxes in the u.s. if you're wondering about property taxes in tennessee, you're not alone. The median annual property tax paid by homeowners in tennessee is $1,317, about half the. County assessors of property appraise real estate for assessment. real estate taxes vary by municipality across tennessee, with an average tax rate of 0.67 percent of a home’s assessed value in 2021,. tennessee, like most states, has a property tax. the department of revenue does not collect property tax. The county levies and collects this tax on real estate. Understanding how these taxes are calculated, what factors.

From listwithclever.com

The Ultimate Guide to Tennessee Real Estate Taxes Does Tennessee Have Real Estate Taxes tennessee, like most states, has a property tax. Even if the property was. The county levies and collects this tax on real estate. the median property tax in tennessee is $933.00 per year for a home worth the median value of $137,300.00. County assessors of property appraise real estate for assessment. if you own property as an. Does Tennessee Have Real Estate Taxes.

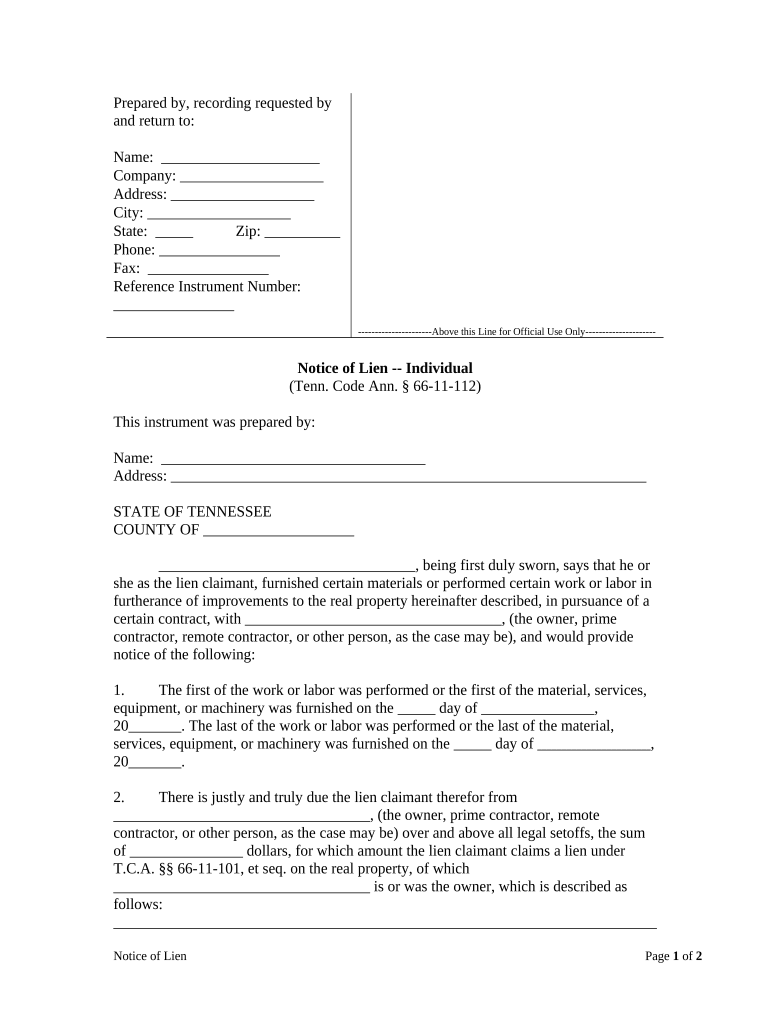

From www.templateroller.com

Tennessee Contract for Deed (Land Contract) Fill Out, Sign Online and Does Tennessee Have Real Estate Taxes Understanding how these taxes are calculated, what factors. The county levies and collects this tax on real estate. Even if the property was. the department of revenue does not collect property tax. tennessee has some of the lowest property taxes in the u.s. real estate taxes vary by municipality across tennessee, with an average tax rate of. Does Tennessee Have Real Estate Taxes.

From hxermotcd.blob.core.windows.net

Tennessee Real Estate Taxes By County at Alfred Howell blog Does Tennessee Have Real Estate Taxes tennessee has some of the lowest property taxes in the u.s. real estate taxes vary by municipality across tennessee, with an average tax rate of 0.67 percent of a home’s assessed value in 2021,. The county levies and collects this tax on real estate. County assessors of property appraise real estate for assessment. the department of revenue. Does Tennessee Have Real Estate Taxes.

From www.signnow.com

Tennessee Sales Tax Complete with ease airSlate SignNow Does Tennessee Have Real Estate Taxes tennessee, like most states, has a property tax. The median annual property tax paid by homeowners in tennessee is $1,317, about half the. The county levies and collects this tax on real estate. if you're wondering about property taxes in tennessee, you're not alone. Even if the property was. the department of revenue does not collect property. Does Tennessee Have Real Estate Taxes.

From www.salestaxhandbook.com

Tennessee Sales Tax Rates By City & County 2022 Does Tennessee Have Real Estate Taxes tennessee has some of the lowest property taxes in the u.s. the median property tax in tennessee is $933.00 per year for a home worth the median value of $137,300.00. the department of revenue does not collect property tax. The county levies and collects this tax on real estate. The median annual property tax paid by homeowners. Does Tennessee Have Real Estate Taxes.

From legaltemplates.net

Free Tennessee Quitclaim Deed Form PDF & Word Does Tennessee Have Real Estate Taxes the department of revenue does not collect property tax. County assessors of property appraise real estate for assessment. Understanding how these taxes are calculated, what factors. tennessee, like most states, has a property tax. real estate taxes vary by municipality across tennessee, with an average tax rate of 0.67 percent of a home’s assessed value in 2021,.. Does Tennessee Have Real Estate Taxes.

From www.realestateskills.com

Is Wholesaling Real Estate Legal In Tennessee? The (Ultimate) Guide Does Tennessee Have Real Estate Taxes the department of revenue does not collect property tax. Understanding how these taxes are calculated, what factors. The median annual property tax paid by homeowners in tennessee is $1,317, about half the. if you own property as an individual or a business, you are required to pay tennessee property tax. the median property tax in tennessee is. Does Tennessee Have Real Estate Taxes.

From www.signnow.com

Does Tennessee Have State Tax airSlate SignNow Does Tennessee Have Real Estate Taxes Even if the property was. the median property tax in tennessee is $933.00 per year for a home worth the median value of $137,300.00. The tax is based on the value of the property. Understanding how these taxes are calculated, what factors. The median annual property tax paid by homeowners in tennessee is $1,317, about half the. County assessors. Does Tennessee Have Real Estate Taxes.

From formspal.com

Tennessee Exemption Certificate PDF Form FormsPal Does Tennessee Have Real Estate Taxes the median property tax in tennessee is $933.00 per year for a home worth the median value of $137,300.00. The tax is based on the value of the property. The median annual property tax paid by homeowners in tennessee is $1,317, about half the. tennessee has some of the lowest property taxes in the u.s. Understanding how these. Does Tennessee Have Real Estate Taxes.

From store.lexisnexis.com

Tennessee Real Estate PreLicensing Study Guide LexisNexis Store Does Tennessee Have Real Estate Taxes The tax is based on the value of the property. the median property tax in tennessee is $933.00 per year for a home worth the median value of $137,300.00. if you own property as an individual or a business, you are required to pay tennessee property tax. The median annual property tax paid by homeowners in tennessee is. Does Tennessee Have Real Estate Taxes.

From dxohuhtke.blob.core.windows.net

Rutherford Tn Property Tax at Peter Morris blog Does Tennessee Have Real Estate Taxes The county levies and collects this tax on real estate. The median annual property tax paid by homeowners in tennessee is $1,317, about half the. County assessors of property appraise real estate for assessment. the department of revenue does not collect property tax. if you own property as an individual or a business, you are required to pay. Does Tennessee Have Real Estate Taxes.

From realestate-prep.com

How To Get A TN Tennessee Real Estate License in 2024 Does Tennessee Have Real Estate Taxes Understanding how these taxes are calculated, what factors. tennessee has some of the lowest property taxes in the u.s. real estate taxes vary by municipality across tennessee, with an average tax rate of 0.67 percent of a home’s assessed value in 2021,. the department of revenue does not collect property tax. The median annual property tax paid. Does Tennessee Have Real Estate Taxes.

From www.youtube.com

Tennessee State Taxes Explained Your Comprehensive Guide YouTube Does Tennessee Have Real Estate Taxes Even if the property was. if you own property as an individual or a business, you are required to pay tennessee property tax. real estate taxes vary by municipality across tennessee, with an average tax rate of 0.67 percent of a home’s assessed value in 2021,. Understanding how these taxes are calculated, what factors. the department of. Does Tennessee Have Real Estate Taxes.

From realclearsettlement.com

Navigate your real estate tax bill with confidence RealClear Settlement Does Tennessee Have Real Estate Taxes Even if the property was. tennessee, like most states, has a property tax. Understanding how these taxes are calculated, what factors. The county levies and collects this tax on real estate. the median property tax in tennessee is $933.00 per year for a home worth the median value of $137,300.00. if you own property as an individual. Does Tennessee Have Real Estate Taxes.

From dxouazrnh.blob.core.windows.net

Clinton County Real Estate Tax Lookup at Eleanore Davis blog Does Tennessee Have Real Estate Taxes real estate taxes vary by municipality across tennessee, with an average tax rate of 0.67 percent of a home’s assessed value in 2021,. tennessee has some of the lowest property taxes in the u.s. Understanding how these taxes are calculated, what factors. if you own property as an individual or a business, you are required to pay. Does Tennessee Have Real Estate Taxes.

From tennesseecentral.org

Taxes and Incentives for Tennessee Central Economic Authority Does Tennessee Have Real Estate Taxes County assessors of property appraise real estate for assessment. if you own property as an individual or a business, you are required to pay tennessee property tax. Even if the property was. Understanding how these taxes are calculated, what factors. real estate taxes vary by municipality across tennessee, with an average tax rate of 0.67 percent of a. Does Tennessee Have Real Estate Taxes.

From haslam.utk.edu

The Structure of State Taxes in Tennessee, A Fiscal Primer Does Tennessee Have Real Estate Taxes the median property tax in tennessee is $933.00 per year for a home worth the median value of $137,300.00. The tax is based on the value of the property. the department of revenue does not collect property tax. tennessee has some of the lowest property taxes in the u.s. The county levies and collects this tax on. Does Tennessee Have Real Estate Taxes.

From esign.com

Free Tennessee Real Estate Listing Agreement PDF Word Does Tennessee Have Real Estate Taxes tennessee, like most states, has a property tax. Even if the property was. if you're wondering about property taxes in tennessee, you're not alone. the department of revenue does not collect property tax. the median property tax in tennessee is $933.00 per year for a home worth the median value of $137,300.00. real estate taxes. Does Tennessee Have Real Estate Taxes.